Most Americans are confident in money management, but concerns remain

The main concerns in recent years have been rising costs and increased interest rates. However, there are ways to address these.

A recent WSFS Bank survey found that a majority of Americans are confident in their ability to manage their money. This includes 91% of respondents in the Greater Philadelphia and Delaware region.

However, concerns are prevalent, as 34% of the region were not confident they could weather the storm of an economic downturn or recession.

The study surveyed 1,001 residents of the Greater Philadelphia and Delaware region and 1,000 national respondents.

With 34% of regional respondents and 39% nationally stating they were not confident they could afford rising costs of living, many are making changes to their spending habits as a result.

About 61% of total regional respondents said they are cutting back on non-essential spending, compared to 69% nationally, while 42% of regional respondents said they are delaying a large purchase like a home, car or furniture.

Two key factors play a role in that concern — rising costs and inflated interest rates.

“High interest rates are making borrowing more expensive,” said Shari Kruzinski, Executive Vice President and Chief Consumer Banking Officer at WSFS Bank.

However, one silver lining Kruzinski finds in this is the opportunity to earn more on your savings through tools like High Yield Money Markets and Certificates of Deposit (CDs).

“The most important thing is to strive to maintain a balanced budget. If you need more assistance, consider setting up an appointment with your local banker to discuss the accounts, products and services that may work best for your unique financial situation,” she added.

RELATED CONTENT

With the current economic environment, about 52% of regional respondents said that building an emergency fund is their top goal. This is followed closely by 49% stating increasing their savings in their retirement accounts, and 47% saying paying off debts.

Respondents point to financial education as the leading catalyst for financial confidence. However, it’s something that isn’t equally accessible to all.

Regionally, 44% felt they did not receive enough financial education and guidance about managing their finances; a figure that rises to 52% nationally.

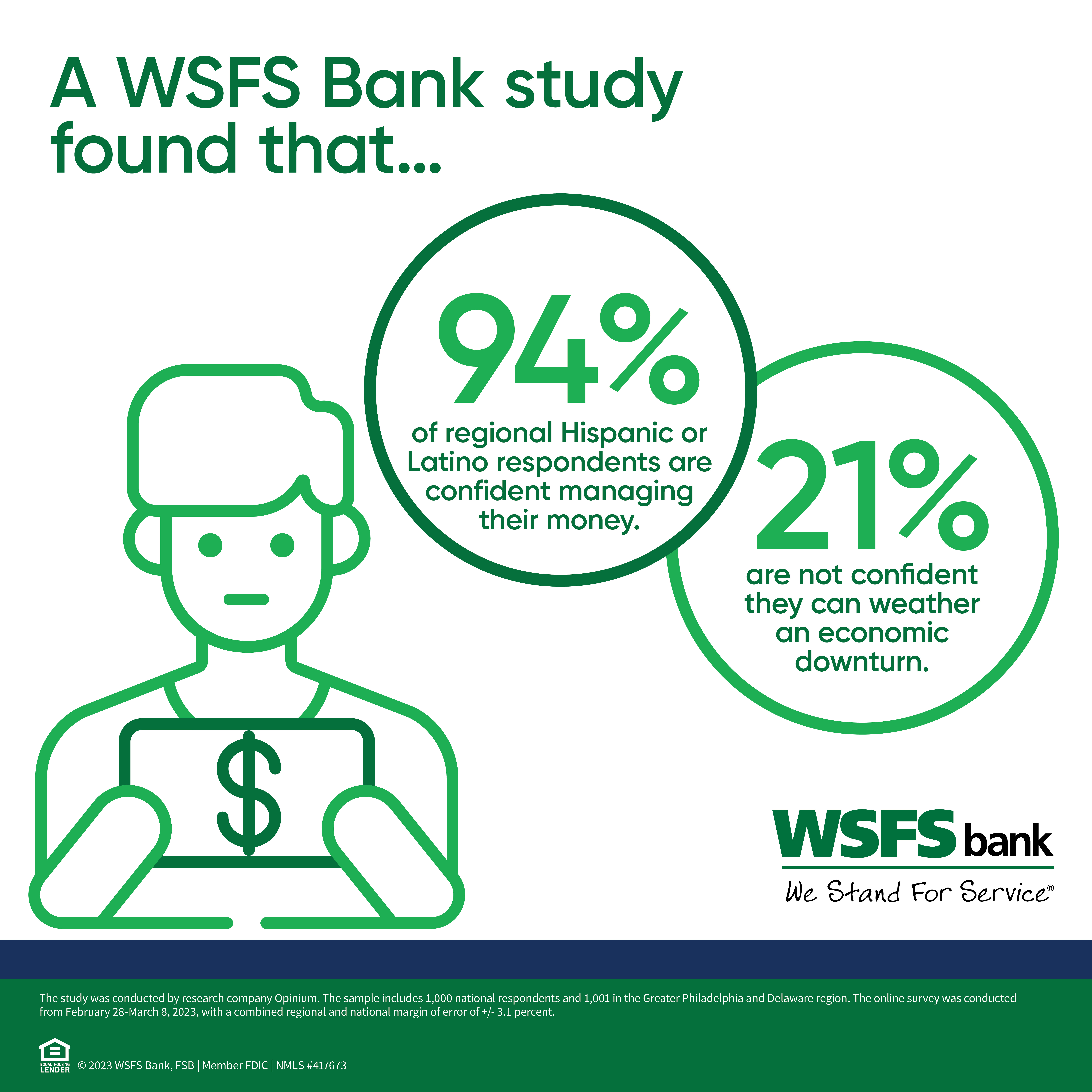

Black regional respondents were more likely to agree with that sentiment (55%), compared to 45% of White and 30% of Latino/Hispanic respondents, respectively.

“Financial education plays a key role in building the confidence needed to achieve many major goals in life,” said Vernita Dorsey, Senior Vice President, Director of Community Strategy at WSFS Bank. “We understand the importance of working with the broader community to provide key lessons to students and adults of all age ranges. Learning is lifelong, and I encourage consumers to use tools like the for tips and resources, in addition to our in-person Associate led workshops to further build their financial confidence.”

About 71% of regional respondents said they wish they had received more financial education, compared to 64% nationally.

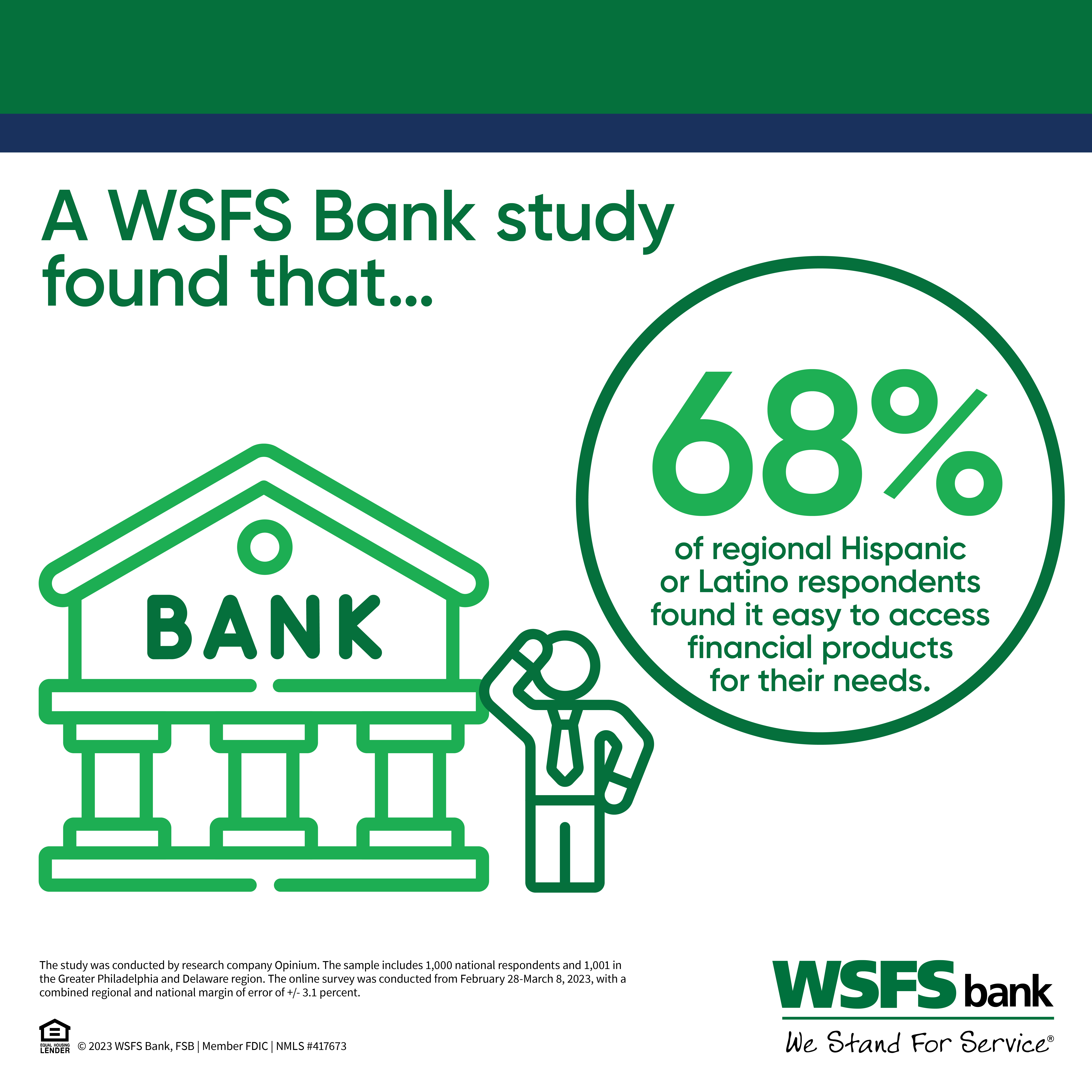

Meanwhile, about 62% in the region said they found it easy to access financial products to meet their individual needs, with Hispanic respondents most likely to agree (68%), followed by 64% of White and 47% of Black respondents, respectively.

While inflation and rising costs have continued to have a major impact on many consumers’ financial security and goals, financial literacy and financial access are important factors in building the confidence of consumers’ to weather the storm.

LEAVE A COMMENT:

Join the discussion! Leave a comment.