The Importance of Reinvesting in Your Small Business

For small business owners, reinvesting through real estate can pay huge dividends in profit and finances.

Understanding and embracing change is one of the most important aspects of successfully running a small business.

Everything from consumer or client behaviors, to wants and needs and vendor or supplier management, staying on top of potential changes that can affect your business is critical.

However, one of the most important changes to embrace is reinvesting in the business. One of the several ways to do so is through real estate.

WSFS provides some ways reinvesting in your business through real estate can increase profitability and strengthen your finances.

One way is that it establishes cost certainty, as purchasing property for your business allows you to not have to deal with rising lease costs. Purchasing your own property with a commercial real estate loan for small businesses provides cost certainty with fixed terms, rates and fees.

These loans also help secure financing for the acquisition of a building, the refinancing of an existing commercial property, or for making improvements to existing property.

Reinvesting in your business can also generate revenue, such as allowing the opportunity to lease part of the space or having a residential tenant.

For those who already own property for their business, reinvesting can also help build equity and add long term value to your business.

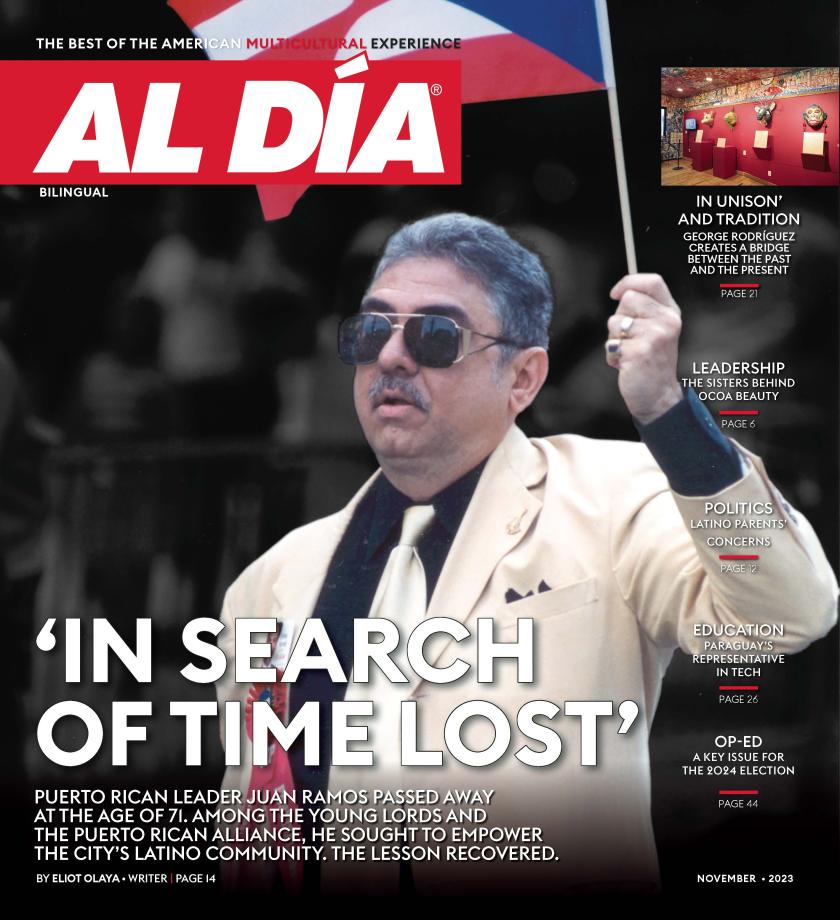

José Fernandez, entrepreneur and founder of Atilio’s Construction, was heavily aided by WSFS.

RELATED CONTENT

After starting his company, Fernandez knew he needed financial support to help grow his business.

Within a year of opening a small business banking account with WSFS, Fernandez was able to purchase his first new vehicle.

By year two, he managed to take his business to the next level by applying for and obtaining a line of credit.

This helped Fernandez take on larger, more valuable projects, and his company is now being booked for projects six months in advance and growing from $20,000-$30,000 jobs to $500,000 full construction projects.

Fernandez’s relationship with WSFS has simply grown more and more over the years, beyond Atilio’s Construction.

“I now have four loans and a line of credit through WSFS between Atilio’s and personal financing, including a second truck, a Jeep and I’m soon settling on a property that I’m going to fix up for investment,” Fernandez said in a 2021 WSFS Bank article.

“I’m a minority small business owner who needed a financial partner who believed in me. I needed someone by my side during the pandemic when times were tough. I needed someone to come on this journey with me to grow into a successful businessperson. WSFS had my back. They never saw me as anyone but José from Atilio’s Construction, our friend and partner, and that approach is exactly what I needed,” he continued.

LEAVE A COMMENT:

Join the discussion! Leave a comment.